Asymmetric Returns = Wealth.

10 Fastlane strategies to end financial stress and pave your way to real financial freedom.

A paradigm shift isn't needed because the paradigm is shit.

Asymmetric Returns = Wealth.

A paradigm shift isn't needed because the paradigm is shit.

Is the World Economic Forum or another government organization giving you financial advice? How about that hypocritical billionaire who made a fortune in business but tells you to eat ramen, cut up our credit cards, and clip coupons? Take your pick; there are a half-dozen of them. Are corporate finance media outlets your source of wealth and financial freedom? How about your broke buddy who knows everything?

Whenever I read a "How to become a millionaire," or a "How to get rich" article plastered on the front page of CNBC or Yahoo Finance, my initial reaction is bewilderment, followed by sadness. First, people read this garbage in droves, and second, they believe it without question.

Suppose the road to wealth was just so simple as a good 401(k), saving 10% of your paycheck, and investing it into an index fund. Wouldn't we be flush with 60 and 70-year-old millionaires by now?

After suffering through umpteen articles about "how to retire rich," it's clear that none of these articles have been written by anyone rich. And when I say rich, I mean time and money. Not just time.

A broke beggar on the street corner is as time affluent as one of these FIRE clowns who claim to have "retired early" because they live like a broke coed. From my multimillionaire standpoint, these people don't have a damn clue what they're talking about. They're simply regurgitating obsolete concepts evolving from an outdated life template that leads to either failure or middle-class mediocrity. As for the billionaires who spout this garbage? Simple. Their companies need obedient employees, not new competitors.

Mediocre advice from mediocre people living mediocre lives will get you exactly that; mediocre.

So why take advice on financial security from me?

Well, for starters, I have financial freedom; a type of freedom that very few have. The picture of the lavish estate above is actually my home, not a Google image search. And guess what? The reason I can afford living in home that rivals some of the best resorts has nothing to do with working a job, investing in an index fund, eating bugs, castrating budgets, or starving myself of life experiences.

In fact, when I look back on my largest financial losses, they all trace back to either the stock market (OMG, the markets are crashing!) or the housing market (OMG x 2 - that house I bought is worth half as much!)

The fact is, ordinary financial assets, as parroted in the mainstream, played no role in the dream I'm living. Mediocre advice from mediocre people living mediocre lives will get you exactly that; mediocre.

The fiscal tricycle is an erroneous financial belief that index funds, jobs, and home ownership will someday make you rich. These three financial amigos have proven to be gross failures. And sadly, those failures doesn't show their incompetence until you've given it decades of allegiance.

The problem with the fiscal tricycle as a plan for wealth is that it is grounded on markets you cannot control or leverage. The job market, stock market, and housing market—is any of this within your power?

Adopt the fiscal tricycle, and you relinquish control over your financial plan. Your plan is at the mercy of the uncontrollable markets and is often, inflationary.

Look around. Hit Reddit. Twitter. Most people are struggling. People with MBAs are selling shoes during the day and waiting tables at night. College grads are pouring coffee and living with their parents until they are 30. Other employees have good jobs but speak of "quiet quitting." The retirement age has morphed from 65 to 6 feet under till death does employment part. You're witnessing firsthand the dire consequence of the fiscal tricycle as a financial plan.

When the tricycle is your wealth strategy, plan on praying. Your plan is a Plan of Hope.

Hooray for hope, hope, and hope! In other words, freaking good luck.

If you cannot control your financial plan, sorry, champ, but you're not in control of your life.

Dump your misguided belief that a holy trinity of uncontrollable financial apparatuses will someday make you rich. I don't care who you are: the value of your home, the value of your stock portfolio, or the value of your employed salary will never increase by 500, 5000, or 50,000% next year. It is mathematically impossible. As a Fastlane entrepreneur, you're not handcuffed by mathematical limitations and instead enjoy potential asymmetry— you could be broke today and a millionaire next year.

Sorry, but saving ten bucks a week because you stopped drinking Starbucks isn't going to make you rich.

This simpleton advice is everywhere: TV, radio personalities, bloggers, magazine articles, and on the front page of Yahoo Finance, a daily smattering of mediocre advice dispensed from mediocre people, all designed to keep you pinned down to a miserable existence of lack and deprivation.

If you want a different life, one of affluence and real financial freedom, dump conventional wisdom. Soul-suffocating frugality and index funds aren't the answer. Entrepreneurship is. Namely, Fastlane Entrepreneurship.

To put your finances into the "no-limit lexicon," not just any business will work. Most small business owners are as broke as their employed counterparts. Broke employee or broke employer, this is no difference. To ensure you don't end up with a business that consumes your life instead of setting you free, leverage the 5 Fastlane Commandments of business, CENTS: Control, Entry, Need, Scale, and Time. These Fastlane commandments are your best chance at earning an asymmetrical return in your business.

A Fastlane strategy is offensive attack on wealth, where incomes and asset values explode with small investments in time and/or money. Instead of making $50,000 a year in your job, you make $50,000 a month. An asymmetrical outcome is starting a business with $5000 and turning it into a $50M company within five years. An asymmetrical outcome is creating a product or service that millions buy.

Simply put, a Fastlane strategy uncaps the limitations of math that 99% of the world suffers under. If your business falls short on these Commandments, you'll likely fall short on the scales of wealth accumulation as well.

Don't replace one fiscal tricycle with another. Driving a 650-horsepower supercar and peddling a tricycle are both exercises of power and force, yet both yield different outcomes. Not only do you want to control, but you want control over something powerful. Aim to drive a Fastlane business that has the potential to flourish into a supercar, not a tricycle driven by the economy.

So you want to start a business?

Great. Here's some more bad advice to avoid: "Follow your passion" and "do what you love" are not successful business premises. They are often fool's gold, commonly mimicked by bloke bloggers trying to appeal to the masses. Just because you love playing the hip-hop harmonica or knitting donkey hats doesn't change market dynamics. Your personal motives and "loves" for starting a business are absolutely irrelevant to the marketplace.

I can spot a self-centered "do what you love" entrepreneur a mile away. Their businesses drown in saturated marketplaces, often solving no needs or problems, rotting into the "sell your soul for the best price" existence. I call it for what it is—a selfish entity conceived from a selfish mindset. It foreshadows failure.

Seriously, the market is as selfish as a hungry 3-year-old. And it only cares about what it needs, wants, and desires. This means solutions! Convenience! Satisfaction! Mindless entertainment! Feeling good! Looking good! Making money! Saving money! Problem avoidance! The list is endless!

In other words, what does the market want and will pay for? Why on Earth should the market give a college dropout money? What value are you bringing to the world? If I'm suffering from cancer and you have the cure, I don't care about your personal ambitions or that you're a college dropout—here, take my damn money! Please give me the cure!

So before you jump off a cliff and create a business, STOP AND THINK — are you getting into business to become a producer of relative value? Or a selfish "do what you lover" who doesn't care about anything but himself?

Relative Value is fire and like printing money because it generates word-of-mouth sales, transforming marketing into an accelerant. One plus one equals three. And the business grows with little to no marketing.

Don't lose yourself in the semantics.

If you've already been dabbling in the entrepreneurial subculture, you've already heard about "creating value." But likely nothing about the real impetus for sales and growth— Relative Value.

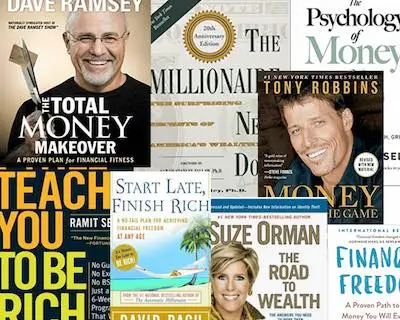

Relative value means that your offer is unique, different, or better than what is currently offered. For example, making a blog post about 10 great "must-read" books has value. But it DOES NOT have relative value. Lists like this are a dime of dozen. Does anyone need to read another list of books with the same old books that are always recommended? If everyone has already read the stalwarts such as Think and Grow Rich and The Richest Man in Babylon, why is everyone still poor?

In a similar example, I compiled a list of "must-read" books that are little-known and underexposed. In other words, I was compiling a valuable document of great books that are NOT best-sellers and don't have mainstream hype behind them. When I announced this document to my readers, the reception I received was shocking. Everyone wanted it.

Why? Because it had RELATIVE VALUE.

A document listing the same old books everyone on every corner of Earth recommends is NOT valuable. It's more of the same.

Relative value is fire and like printing money because it generates word-of-mouth sales, transforming marketing into an accelerant. One plus one equals three. And the business grows with little to no marketing.

So drop the "passion" and "love" motives as the impetus to start a business. The market is incredibly selfish, chewing and spitting out "do what you love" businesses for breakfast, lunch, and dinner. Instead, get into business with a problem-solving and relative value foundation. This is the "N" or Need in the Fastlane CENTS Framework. Succeeding with this focus will give you the second-order consequence of financial freedom. And happiness. Yes, feed the market with relative value, and the market will feed you beyond your wildest dreams.

Sorry to ruin the fairytale, but nothing outstanding in your life will ever come easy. Significant accomplishments don't occur overnight or in short bursts, like winning a lottery or a poker tournament. They will take years of constant action marred by failure, sacrifice, and discipline.

Starting a business from zero is like learning a new skill, like piano, or a new sport, like baseball. And yet, most people approach the monumental task like a leisurely trip to the beach with a laptop. Or a short trip to the casino to play roulette. Sorry, but these people have watched one too many Tai Lopez videos.

When I reflect on and examine every accomplishment in my life, I realize that each has had a significant price. That price was paid by a dirty phrase in today's culture: hard work.

This piece of advice will cost me book sales, but you can only read so many books about swimming; at some point, you have to jump in the pool.

If you want substantial changes in your life, expect to change yourself substantially. Start with changing your financial plan from the Slowlane fiscal tricycle, to the Fastlane. Then, expect difficulty, long hours, sacrifices, and failure to thwart your journey. Expect doubt and apprehension. Expect many things to test your resolve. Own these realistic expectations, and they will help you survive the coming storms, those lonely canyons of tribulation that echo, "Will this ever work?" or "Why is no one buying?"

If you expect Fastlane to be as simple as registering a few domain names or buying the latest crypto shitcoin, don't even bother. You'll be disappointed. And following your disappointment, I'm sure to hear, "this Fastlane shit is a total scam."

If success was easy, everyone would be grinning on the beach with an umbrella drink and an open laptop, cuz ya know, you're making bank from those two posts you made on that fresh install of WordPress. Get freaking real.

Instead, treat business like a sport, such as baseball. To get better at baseball, you have to play the game.

Daily.

This piece of advice will cost me book sales, but you can only read so many books about swimming; at some point, you have to jump in the pool. Leave the dugout and get to bat. Take swings. Strike out, foul out, and hit singles. If you strike out once and resign, "Eh, this Fastlane shit don't work!" then you have failed expectations.

Few people can sit at the piano for the first time and be an instant maestro. Expect the ride to be rough and the journey to be purifying. Those committed to it stay focused and move closer to the goal— those who aren't are ushered back to the wage-slaving cubicle and the pipe dreams of a mindless MLM. Warped expectations will kill your dreams.

It will not be easy, but I can guarantee it will be rewarding. Hard work on the fiscal tricycle gets you no where. Hard work in the Fastlane puts you on a private jet. Choose wisely and change your life forever.

Still with me?

Great. Unfortunately, it doesn't mean a damn thing.

Your agreement with me on points 1 through 5 doesn't mean jack because likely you won't do a darn thing about it. The fact is, your priorities are too messed-up to ever succeed at the entrepreneurial game.

TikTok dance reels are too important.

Politics on Twitter is too addictive.

American Idol is just too damn entertaining.

The NY Yankees' 83rd game of the year is just too "must see."

Kim Kardashian's latest bikini Instagram is just too jaw-dropping to ignore.

You see, actions express priorities. People love to say they want to lose weight, but the next thing you know, they're buying cartons of ice cream. Talk is cheap; actions speak truth.

How you spend your time NOW will determine how you spend your life LATER.

If 30 hours of your week is consumed in entertainment, drinking, and goofing off, that's your priority—not financial freedom.

As I write this, I have no clue who won the World Series last year. I could be sitting on a plane in 1st class next to the latest winner of The Voice and not have a damn clue who he or she is. I can't recall the last time I went to a movie theatre. The fact is, I don't give a shit. These things aren't important in my life.

Want to know what's important to me?

Freedom. Family. No boss and no alarm clock. Doing what I want, where I want. Walking into a store and not having price be an issue. No debts. No bills. Making a difference. Writing without censor from a publishing company. Reading an email from someone who said The Millionaire Fastlane has changed their life. This is what's important to me; not some hip-hop mogul's love child conceived atop a mountainside in Tuscany.

How you spend your time NOW will determine how you spend your life LATER.

If you genuinely want to create something powerful, your addiction to entertainment and other mindless distractions must be retired and replaced with meaningful action. Most people would rather win an imaginary game on a computer screen than real life. Which one will be more important to you? Get to the plate and swing! And don't worry if you're first swings result in a strike-out! It likely will! Just remember; Fastlane isn't something you try, it is something you live.

Owning the cure for cancer means nothing if you can't sell it. A great product dies if no one believes your message or you can't reach the right audience. As an entrepreneur, you will ALWAYS be selling.

Obviously, you'll sell to customers to generate revenue. This is known as marketing and branding, the primary method for creating Relative Value.

For example, suppose you create a great product but soon discover another entrepreneur invented a nearly an identical product. In that case, the best marketer will win the game. The best marketer reaches the right people and convinces them to buy. The poor marketer is trapped in his basement with a great product but no buyers.

Aside from marketing-specific activities, sales also mean selling to potential employees, suppliers, vendors, investors, and bankers. Perhaps even to politicians and lonely spouses. You're constantly selling, even if you don't know it.

Sales and effective communication is an art in itself. And no matter if you succeed or fail in business, learning how to sell, negotiate, and communicate, is a skill that translates well in life. Knowing how to sell can save you thousands when buying a car or millions when negotiating a deal. Heck, getting married is a sales process, from the wedding to convincing your spouse to say "YES.

Elevating your sales competence is a win/win for life.

A wolf doesn't give a shit about the opinions of sheep.

The pro baseball player with a 100 million dollar net worth doesn't care about the bus driver heckling him from the nosebleed bleachers.

I have a YouTube channel with probably thousands of comments. I'm sure many of them are negative. Most of them I don't read. I simply refuse to engage my time and energy with such nonsense. I don't give two shits what some minimum-wage YouTube douchebag thinks. I simply don't care about your opinion on my haircut, my books, or my shirt. If such trivial matters are important to you and worth 17 seconds of your time to warrant a comment, it speaks volumes to how you value your life.

Stop caring about what others think unless they constitute a market.

I've realized that no matter what anyone says on YouTube or on some blog, it doesn't change my reality, and it need not change yours. So if you're chilling in a Vegas penthouse on a month-long vacation, does it really matter that Gary over in Cleveland comments that you're an idiot? Hey, look! I still live like a king! Yup, the champagne is still flowing while Gary is jarring awake to a 6AM alarm, working at some thankless job that is slowly killing his soul.

The reality of the life I created does not change unless I allow it. Anytime you put yourself "out there", you set yourself up for attack. It's part of the process and a part the game. You can't let this stuff stop you. Yes, sometimes it isn't easy but take heart: every successful person, including entrepreneurs, have to deal with it. Think about Elon Musk. Lebron James. The President. Entertainers. Newscasters. They all deal with attacks on their persona.

Expect it and learn to ignore it. Stop caring about what others think unless they constitute a market. And if they do constitute a market bearing feedback on your product or service, listen, then adjust. This brings us to #9...

Succeeding as an entrepreneur in a CENTS-based, Fastlane business amounts to applying the scientific method. I called it the 3As Model which is as follows:

Act. Assess. Adjust.

ACT

The first step is to take meaningful action. Start a side hustle. Invent a product. Develop prototypes. Learn how to code with the goal of starting a software business. Do something!

Don't confuse action with activity or motion.

Motion is a method of action that I call action-faking. Action-faking is useless busywork— insignificant action designed to make you feel good, a temporary psychological massaging that convinces you that you're making progress when in fact, you aren't.

Such "busy work" is varied. Some of you will engage in self-help porn and read countless books but do nothing after completing each. Some of you will register a few domains at GoDaddy and proclaim, "I'm acting!" Others enter a paralyzing road of analysis and research with one goal: To convince themselves they cannot do it, that the idea is bad, or that competition is too stiff.

In other words, you're not in search of a business, you're in search of excuses.

The first step to ACTING is to identify your Relative Value and then define your customer path—the shortest route to your first customer. Find someone who will give you money. Find someone who commits to your product or service. Find someone who submits a form! Get on the phone. Start tweeting. Learn what needs to be learned.

Your road is Relative Value, and your roadmap is the customer path.

ASSESS

In early 2011, about two months after my book was released, it became painfully clear: The Millionaire Fastlane's cover, which I designed and loved, sucked. At every turn—tweets, emails, FB—I heard it.

Great book, just ignore the hideous cover!

Fastlane (despite the cheesy cover) is an awesome book!

By the end of 2011, I knew I had a problem that needed fixing. My gregarious, Lamborghini-inspired, neon-orange-and-green book cover was a turd and turned away potential readers. Luckily, I buried my righteousness and heard the message. After acting and getting a book to market,I shifted to ASSESSING.

Every action pushed into the marketplace comes with a reaction, or form of feedback. And yes, no feedback is also feedback. Your job is to listen, even if it isn't what you want to hear.

Within months of release, the negative comments about my horrific cover were about as regular as a Kardashian selfie. Whenever you interact with the market, ASSESS what is happening or isn't happening.

The next step in the 3A method is ADJUSTMENT. Action and assessment are worthless without a minor change in strategy. The entire point of grinding the first two As is to uncover how to react. Recently, I've heard this concept gain fame from others who refer to ADJUSTMENT as a "pivot."

Well, I started pivoting when most new entrepreneurs were sitting on Santa's lap. Whatever name you give it, adjustment is a strategy redirection based on correlated and compounded market echoes. The key to uncovering actionable feedback comes from recognizing pattern echoes.

I recorded all market echoes in a notebook, which I affectionately called my "black book." Whenever a pattern emerged, I acted on it. If several people think your UI sucks, you can bet the market is thinking the same thing. For example, every new feature addition at your website should come from pattern echoes. When several people request something you lack, you can bet the market thinks similarly.

The same goes for products: if twenty customers ask about a certain color you don't offer, you've exposed a new opportunity and revenue pocket. Heed these echoes, add/subtract where needed, and you've created relative value for your market.

For myself, once I learned that my book cover was an abject failure, I lurched into adjustment: I had the cover redesigned, despite the 8,000 copies already in print. (If you have an old cover edition, hang on to it—it might be a collectible someday.) And guess what? Ever since that change, I NEVER heard another cover comment again. And more importantly, the book went from a few hundred sold to over a million. Thanks to Action, Assessment, and then Adjustment.

Follow this iterative process, and you will hack your way to success.

I love that people read my books and say they changed their life. I hate that people read my books and make impetuous, emotional decisions.

Two such decisions that aren't good choices are the decision to quit your job or drop out of college simply because you were enlightened by my work.

Jobs and college degrees aren't necessarily evil or worthless pursuits. For years I've impugned these things, but only in the context of a Fastlane comparison.

Too many people make rash decisions and quit their job or dropout of college with no plan. No business. And no skills. This likely is not the right decision.

Here are 4 ideal conditions that will help you determine when it is the right time to quit your job or university pursuit. If you cannot meet these conditions, you might be making a rash decision based on emotion.

#1 - Do you have existing sales with adequate profit margins?. Are you repeatedly selling? Can your profits (and potential profits) pay your bills, much less change your life?

#2 - Do you have at least six months of cash flow to pay your bills while adopting a lean lifestyle? Financial stress comes from bill-paying anxiety, which doesn't make building a business any easier. Frugality for the sake of saving thousands is stupid. Frugality to earn millions is not.

#3 - Does your venture have scale and growth potential? Can revenue 10X within the next twelve months? Is your job preventing you from 10X'n your revenues and profit? What systems need to be in place to go 10X?

#4 - Evidence of defensible Relative Value. Are people recommending your business/service/product? Are people reordering? Have competitors entered the market and taken market share? Has your relative value demonstrated longevity?

Hit these four conditions, and quitting your job or university might be the right decision. Until then, keep your job or studies as a means to an end. Make them the goal, and understand the risks of the job gulag. The cubicle dredge of Monday through Friday is like putting your soul through a meat grinder that hasn't been cleaned since the Bush administration. After work, you're drained and dirty. Your motivation pays the price with your dreams choked into the purgatory of "someday."

I get, and I've been there.

The only thing that will set you free is a "screw this" attitude where your dream is the ONLY option. There is no alternative other than forward. Nothing will stop you— not that small apartment on the wrong side of town, not that crappy Subaru with 159,000 miles, not that overbearing "get a good job!" Asian parent—NOTHING!

Until then, everything else is a means to an end, including your job or university studies.

CONCLUSION

Make these strategies part of your life, and the change you seek will arrive. Remember, nothing extraordinary happens under one solitary decision: Eating a piece of broccoli, going to the gym, reading one book; all noble choices, but choices that won't produce earth-shattering change.

Permanent change occurs through the process—hundreds of decisions made over time that engineer a lifestyle... and that lifestyle is what creates the change you seek.

Think about it.

Can you expect a bodybuilder physique hitting the gym once? Can you lose weight eating vegetables for just one day? One decision is an action-fake, while thousands are a lifestyle. Make the Fastlane your lifestyle, and I promise you'll look back and wish you'd done this years earlier.

My best wishes for your success and happiness,

MJ DeMarco, Entrepreneur and Author of The Millionaire Fastlane

Try for Free Get the BookSome books can change how you think. Others can change how you live. Never underestimate what you can achieve in a few short years when you apply the right business methods & allow asymmetrical returns to work their magic.

"I didn't want to work for the rest of my life," said Peter Furling, "so I stopped spending money anywhere I could and because my monthly food expenditures were costing me several $100 per month, I thought, "hey, why not live off the land?"

The most profound article on personal finance you will ever read. And you won't need to spend 12 hours reading a dry 400 page book by a motivational speaker who made billions of dollars selling seminars, not index fund investments.